" Publication 505 (2020), Tax Withholding and Estimated Tax." Accessed April 12, 2021. " Extension of Time To File Your Tax Return." Accessed April 12, 2021.

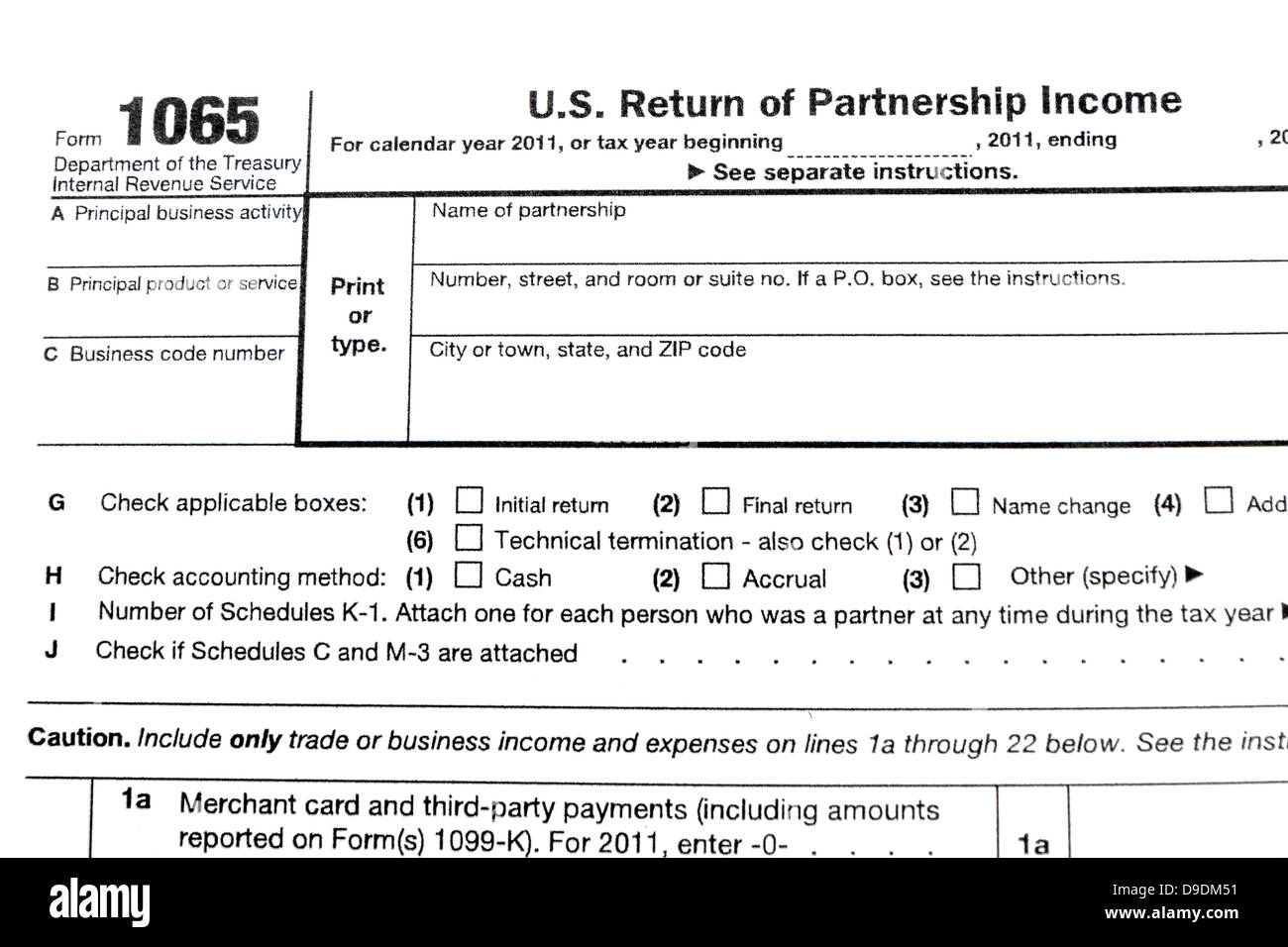

" Shareholder's Instructions for Schedule K-1 (Form 1120-S) (2020)." Accessed April 12, 2021. Partnerships file an information return to report their income, gains, losses, deductions, credits, etc. " 2020 Instructions for Schedule C (2020)." Accessed April 12, 2021. Form 1065 is used to report the income of every domestic partnership and every foreign partnership doing business in the U.S. " IRS Announces Tax Relief for Texas Severe Winter Storm Victims." Accessed April 12, 2021. " Tax Day for Individuals Extended to May 17 Treasury, IRS Extend Filing and Payment Deadline." Accessed April 12, 2021. Sole proprietors file Schedule C with their personal tax returns to arrive at their net taxable business incomes. Its year-end is December 31, and the tax return due date is the same as the individual's-normally April 15, except it's May 17 in 2021.

#WHAT ARE 1065 TAX FORMS HOW TO#

Persons With Respect to Certain Foreign Partnerships, the press release says. Income Tax Return for an S Corporation, and Form 8865, Return of U.S. Written comments should be emailed with the subject line “International Form Changes” to revisions are planned to Form 1120-S, U.S. The IRS invites comments from affected stakeholders through Sept. Because a profits interest does not entit. Schedule K-3 (Form 1065) would replace portions of Schedule K-1, Part III, boxes 16 and 20, according to the press release. Answer: Carried Interest is defined as a profits interest in a fund that is paid to an individual partner without requiring that individual to provide any operating capital it is usually paid in lieu of compensation to that partner, for his sweat equity. Limited partnership a limited partnership is formed under a. Please refer to the following explanations of each type of partnership to determine the appropriate entity type: General partnership a general partnership is composed only of general partners. In comparison with existing forms, Schedule K-2 (Form 1065) would replace portions of existing Form 1065, Schedule K, lines 16(a) through 16(r). There are five different entity types for partnerships. “It is intended that all the information to be reported on the new schedules is already necessary for the partnership to provide to partners or is available to the partnership.”

The international-focused partnership schedules are meant to “better align the information that partnerships provide on the schedules with the tax forms used by partners,” the press release says. Schedule K-3 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc.Schedule K-2 (Form 1065), Partners’ Distributive Share Items - International and.The proposed new schedules for international items, and related instructions, that were released for public comment are: The changes generally would not affect domestic partnerships with no foreign activities or foreign partners to report. income tax liability with respect to items of international tax relevance, including claiming deductions and credits, while also increasing the IRS’s efficiency in verifying taxpayer compliance. The proposed changes are intended to simplify the process for partners to compute their U.S. Return of Partnership Income, to help standardize the format in which partnerships report international tax items, beginning with tax year 2021, according to a July 14 press release. The IRS has proposed adding two new schedules to Form 1065, U.S.

0 kommentar(er)

0 kommentar(er)